As an analyst, most of my time is spent deepening my understanding of our portfolio of companies and researching potential new investment candidates. But every once in a while, I meet with investors in our fund. They always ask “how do you come up with new ideas?” After my deer-in-headlights stun wears off, I usually give a rambling, incoherent monologue and it is a miracle if they don’t pull out their funds immediately.

Why is it so hard for me to describe the work I do every day? I decided to try and put down my approach to idea generation in words as much for my own benefit as for any investors that have had to endure meetings with me.

It is easy enough to outline what we are looking for: good businesses with good management and low valuations relative to their long-term earnings potential. Finding companies that check two of these three boxes is relatively easy most of the time. But if you demand three for three, it means uncovering something misunderstood or hidden about one of those characteristics, whether it is the underlying quality of the business, the capabilities of the managers, or earnings or assets that are not appreciated by the market.

We aim to hold stocks for 5 years or longer, which means we only need to find 5-10 new investments per year. That means the vast majority of companies we examine are rejected. If there is a clear formula for regularly finding truly unique and attractive investment opportunities, I have not seen it.

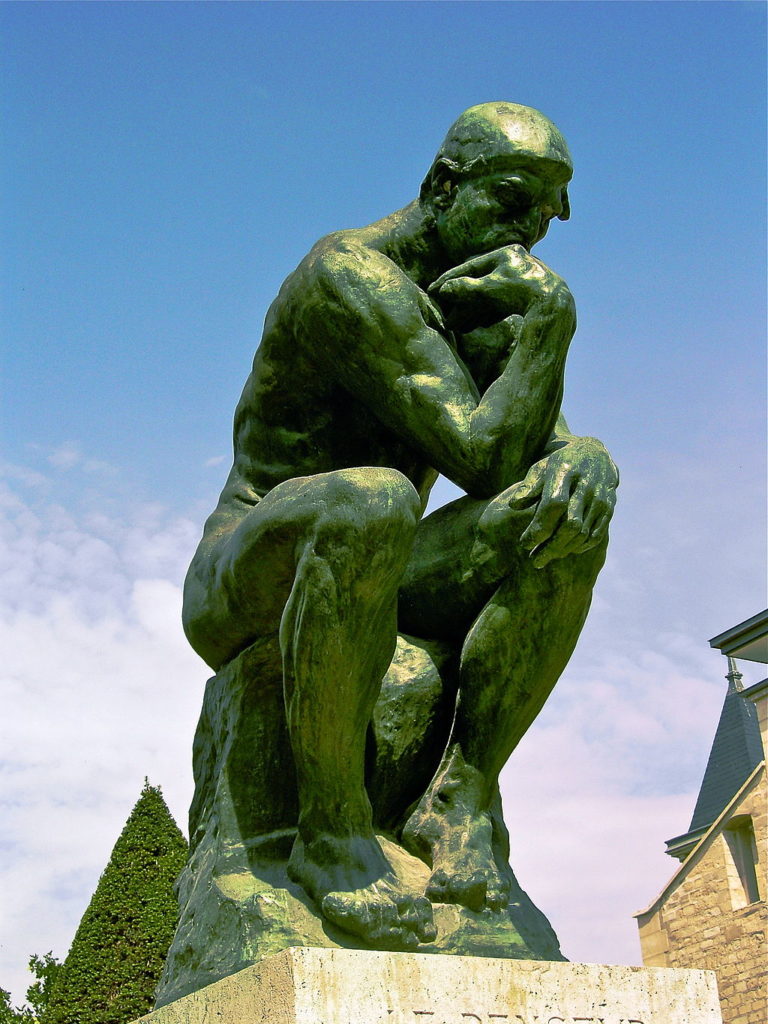

A lot of funds in Japan describe their process similar to the chart below:

They start with a huge universe, screen out everything that doesn’t match their valuation or growth criteria, and from there conduct research that identifies the best of this group. Sounds simple!! It seems to me this process will result in a portfolio of pretty good companies that are already heavily owned by everyone else, but it is unlikely to produce real gems.

We don’t do screening because we want to find something that is by definition not going to be captured by an algorithm. One common way a company becomes misunderstood by the rest of the market is when the reported numbers do not reflect the true earnings power of the business, which is precisely the kind of company that will get weeded out by a screen.

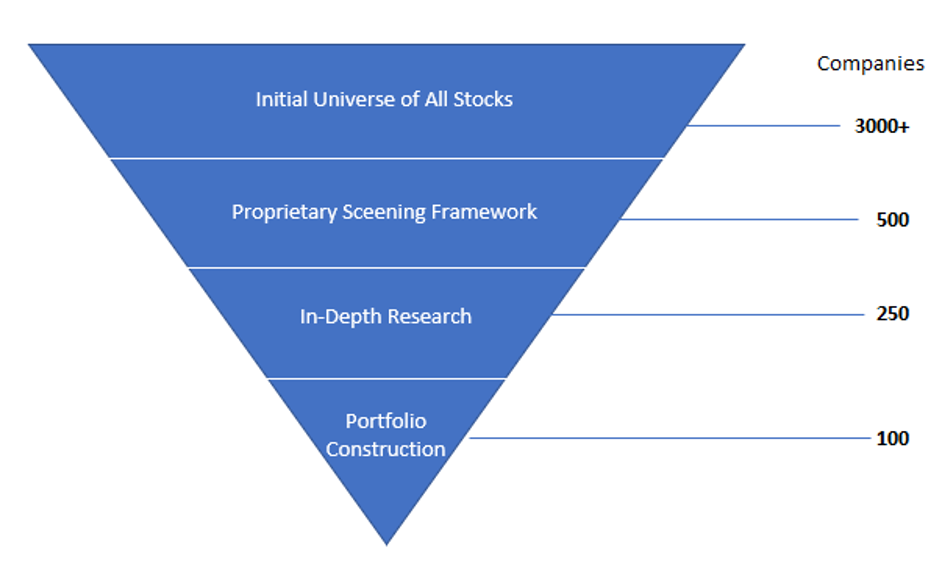

If not screening, what am I actually doing to generate investment ideas? After thinking for a bit, I made my own chart of how I conduct research:

It starts with Inspiration. Another way to put it might be “a seed of an idea.” Rather than start from a very big universe, I instead start with a very simple concept and try to follow it as far as it will go. There is no subtraction of non-candidates, only addition. Everything related to that idea can potentially turn into an investment.

Once I have an Inspiration, I next meet with companies and people that are related to it. Those interviews lead me to other people and other companies. At some point, an “Initial Investment Candidate” may come into view. After a first meeting, it appears they have good economics and an attractive profile. However, as we keep following the thread and meeting more people, another candidate emerges. Maybe this one dominates its niche more fully and is run by an owner operator with a head for capital allocation. In the end, we will start with a small investment in that company and forget the other one. We generally don’t invest in more than one company in a particular field. We want to find the best company, and if we cannot choose between multiple candidates in a field, then we probably don’t have the competence to invest in that industry in the first place.

You might call it an Unraveling Sweater approach to investment ideas – find a string and pull on it as far as it will take you.

Sadly, at least half of these research projects end up leading to dead ends with no new investments made. The fact that it is labor-intensive is probably the reason it still works, though.

One example from last year: we read about the culture at Recruit Holdings from a Bloomberg article . Recruit gives young workers the chance to be entrepreneurial, and often these people leave to start their own businesses, many of which are listed. We love entrepreneurial managers and so made a list of companies with C-suite managers originally from Recruit. We met companies including Lifull, Link and Motivation, Zigexn, V-Cube, Vector, Evolable Asia, and Tsunagu Solutions.

They were all good companies with good managers. But in the end, we didn’t invest in any of them. Recruit is a strong competitor in a field (recruiting) that has low barriers to entry. We found these companies to be similar – they were entrepreneurial and ambitious, but operating in business areas that we were not confident could be defended against competitive threats. I hope they will all do well, but our particular strategy manages risk by investing in companies with entrenched positions. After a number of interviews, we cut the project off to move on to something else.

Another inspiration came from reading a 1997 article about Fastenal, a US maker of fasteners and other auto parts, called The Cheapest CEO in America. This started us looking into companies that are militant about eliminating all excess. Again, although it turned up a number of very interesting companies, we did not invest in any of them. But I actually think this particular project will one day lead us to an investment, so it is a kind of 塩漬け (salt and preserve) Inspiration that I can come back to later.

The tricky part is generating Inspiration. News articles are just one source. There are lots of other ways, and I would like to talk about some of them in a future post. This is the aspect that is hardest to convey to our clients. I don’t know where my next Inspiration will come from and have no systematic way of producing one. But I know if I keep looking, keep talking to people, keep my eyes and ears open, I will stumble upon one every once in a while.